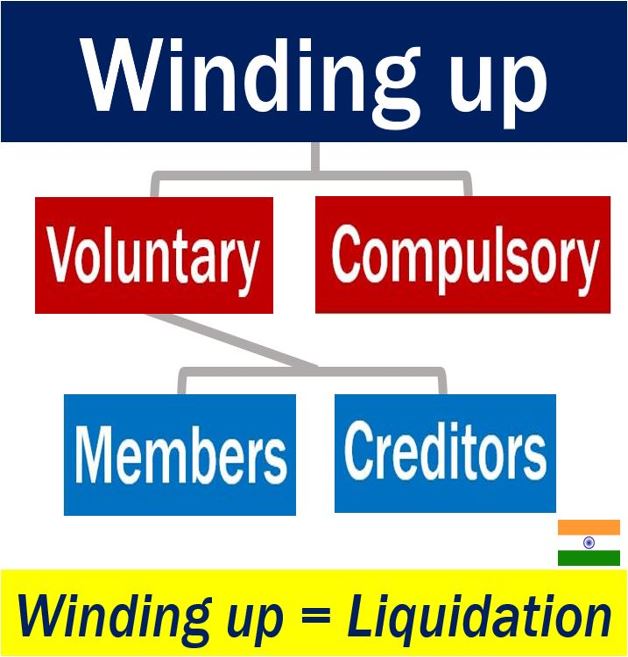

The company can be setup by the company’s rule, likewise the winding up of a company also follows some procedure. The winding up of a company means the life of the company is brought to an end. Winding up is the process by which an organization is finished where the benefits are acknowledged and the installment of obligations are circulated. The properties of the organization are regulated to support the individuals and the banks. Under Companies Act, 2020 a Company might be ended up by the council under Section 272 of Companies Act, 2013. On Companies (alteration) Act, 2002 NCLT and NCLAT were framed.

Voluntary wind up

Voluntary winding up measure: Below is a portrayal of the cycle and there are numerous subtleties engaged with every one of these means. Assertion of dissolvability: The Board of Directors of an organization should present a presentation of dissolvability to the Registrar of Companies, expressing that: (I) the organization has no obligation or that it will have the option to cover its obligations from the returns of resources for be sold in the liquidation cycle; (ii) the substance isn’t being exchanged to dupe any individual, alongside reviewed financials and valuation report by an enrolled valuer.

Corporate resolution

Endless supply of presentation of dissolvability, the organization, inside about a month from the date of announcement of dissolvability should pass an uncommon goal passed by investors of the organization expressing that the organization be sold, and a bankruptcy proficient be named to go about as the outlet.

Reasons for Winding up of company

On January 24, 2020, the Ministry of Corporate Affairs informed principles overseeing the strategy for winding up the company and which will produce results from April 1, 2020. This standard will be relevant just when an appeal is recorded with the council for ending up on grounds other than the powerlessness to pay obligations as referenced under Section 271 of Companies Act, 2013. Before the authorization of these wrapping up rules under Section 361 of Companies Act, 2013 which manages the rundown of continuing, just the accompanying class of organizations would be winding up the company:

Organizations whose book estimation of benefits isn’t more than one crore;

A specific class of organizations which has been referenced by the focal government.

The focal government will delegate the vendor of the organization and he will take all the benefits and noteworthy cases of the organization into his guardianship and inside thirty days he will present the report to focal government including the announcements demonstrating that no extortion has been submitted either in its:

Development

Arrangement and the board of the issues of the organization. Furthermore, when the focal government is fulfilled will give the request for ending up of the organization. With the presentation of Companies (wrapping up) Rules, 2020 the accompanying classes of Companies can straightforwardly document an appeal with the focal government for the injury up. These classes of organizations are excluded from recording an application with NCLT for twisting up. Organizations (wrapping up) Rules, 2020.

Liquidator– Liquidation Process

Outlet

Arrangement of temporary outlet or Company vendor (Rule 14)

A temporary outlet is selected according to Section 273(1) of Companies Act, 2013 for hearing the wrapping up appeal.

Where the organization isn’t the candidate a notification for arrangement of temporary fluid will be given to the organization in the structure WIN 7.

The individual who is in control of property, books, papers, money or some other advantages inferred in this way will give up them to the temporary vendor.

Where a request has been made for naming the temporary outlet or Company vendor the enlistment center will inside seven days private to the organization vendor or temporary outlet in the structure WIN 9 and will send it by post or by another potential methods. Also, it will send the duplicate of arrangement to the enlistment center of Companies alongside the duplicate of appeal and affirmation.

Winding up order

Request to be sent to outlet and type of request (Rule 17)

The wrapping up request will be sent to the recorder after its marked and fixed and it will be sent inside seven days and the request is to be in structure WIN 11 and the request be sent to Company vendor and the enlistment center of organizations in structure WIN 12 and WIN 13 and it is likewise to he joined by a duplicate of appeal and affirmation.

The request made by the Tribunal will be documented by vendor inside thirty days with the enlistment center of organizations in structure INC-28 of the organizations (Incorporation) Rules, 2014.

Organization outlet to assume responsibility for resources, books and papers of Company (Rule 22)

At the point when a wrapping up request is made it will be the obligation of the organization outlet to take the books, significant cases, papers from the organization who was having authority of them prior. In the event that the organization, advertisers, key administrative work force or any individual neglects to help out the outlet then the vendor can document an application to the court for a request.

The court on accepting such request will arrange the organization, advertisers and key administrative work force to give the data as has been mentioned by the outlet or help out him in gathering the data.

Conclusion

Companies (Winding up) rules 2020 presented by the Ministry of Corporate Affairs on January 24, 2020, has acquired critical change the way toward ending up of organizations, lessening the weight of the court, and giving way out chances to classes of organizations. Courts should provide the request to winding up the company just when all the options are smothered else it ought to encourage the organizations to reexamine or reestablish their organizations. When the company is wholly wounded up the property is administered for the benefit of creditors and for the shareholders. The summary procedure provides for the methods of the winding up rather than winding up the company in the situation of inability to pay the debts.